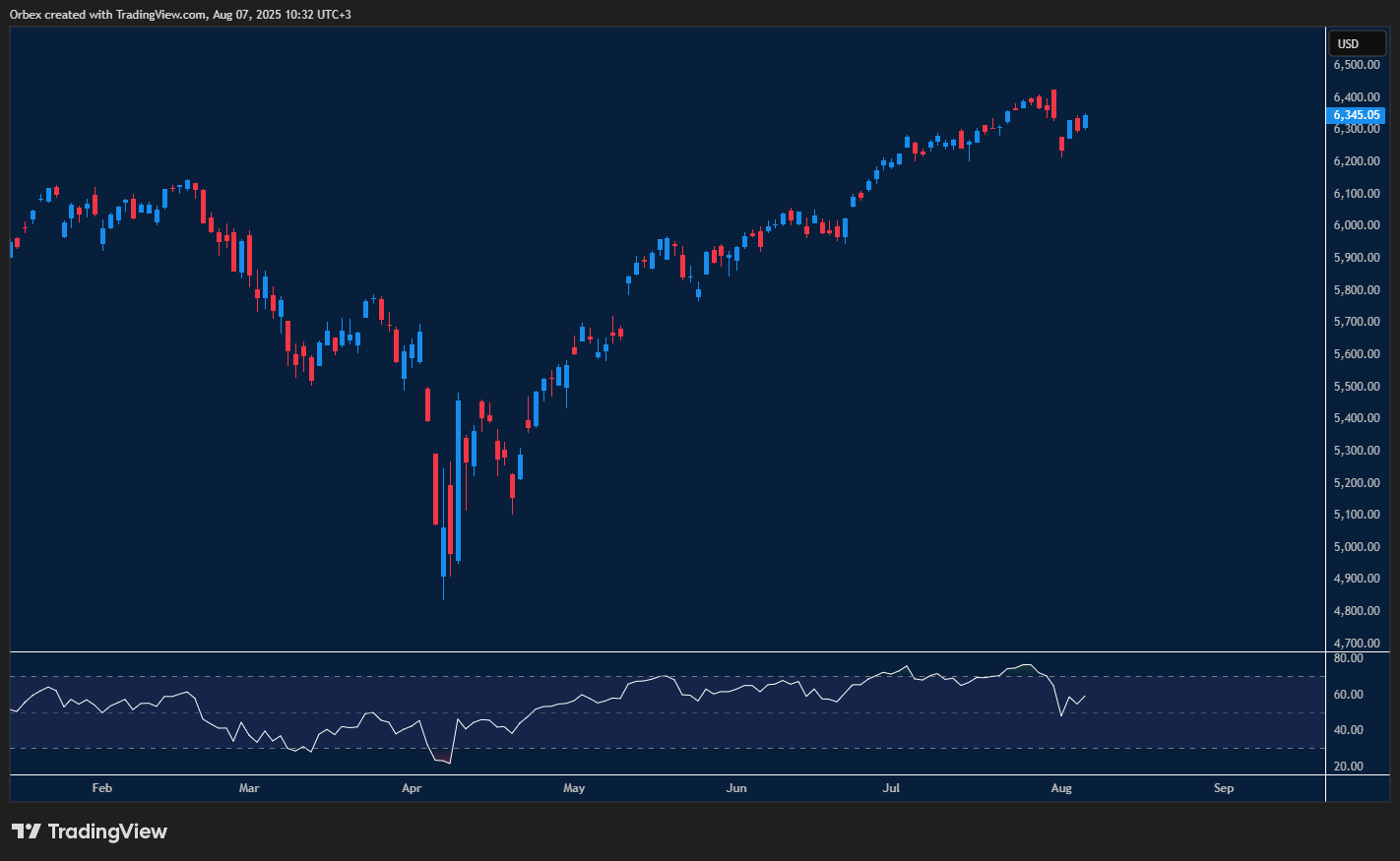

(SPX500) S&P preparing for another record

The (SPX500) S&P looks to bounce back after the recent correction as earnings season continues to be the gift that keeps on giving. With America’s trade policy in focus, it wasn’t a surprise that traders decided to look elsewhere when trading the indices. Stocks seem to keep on flourishing, as Apple last week lifted the market somewhat with its outlook projections. So, a temporary setback, or a complete crash? The index is heading towards 6500, with 6000 acting as a fresh support.

AUDUSD awaiting the next rate decision

The Australian dollar gains further traction as prices look to fully reverse the July peak. This week’s speculation that the RBA will cut rates again means that the greenback could cash in on a possible sell-off in the pair. With the Fed holding on until at least September, the Aussie could fall lower as an unwavering dovish stance could push the pair towards 0.6400, with 0.6620 as a resistance at the previous high.

UKOIL hitting firm support

Brent oil remains in a bearish loop as concerns over future demand weighs heavy on prices. With the comments from OPEC about oversupply, and Donald Trump’s threats to India about buying Russian oil, the sell-off on the black gold has continued. EIA and API data this week could salvage the sell off, but the likelihood is we are heading for another downturn. The price is hanging by a thread over 67.00, with 73.00 serving as the first resistance.

Test your forex and CFD trading strategy with Orbex

The post The Week Ahead – Covering the Weak Spots appeared first on Orbex Forex Trading Blog.