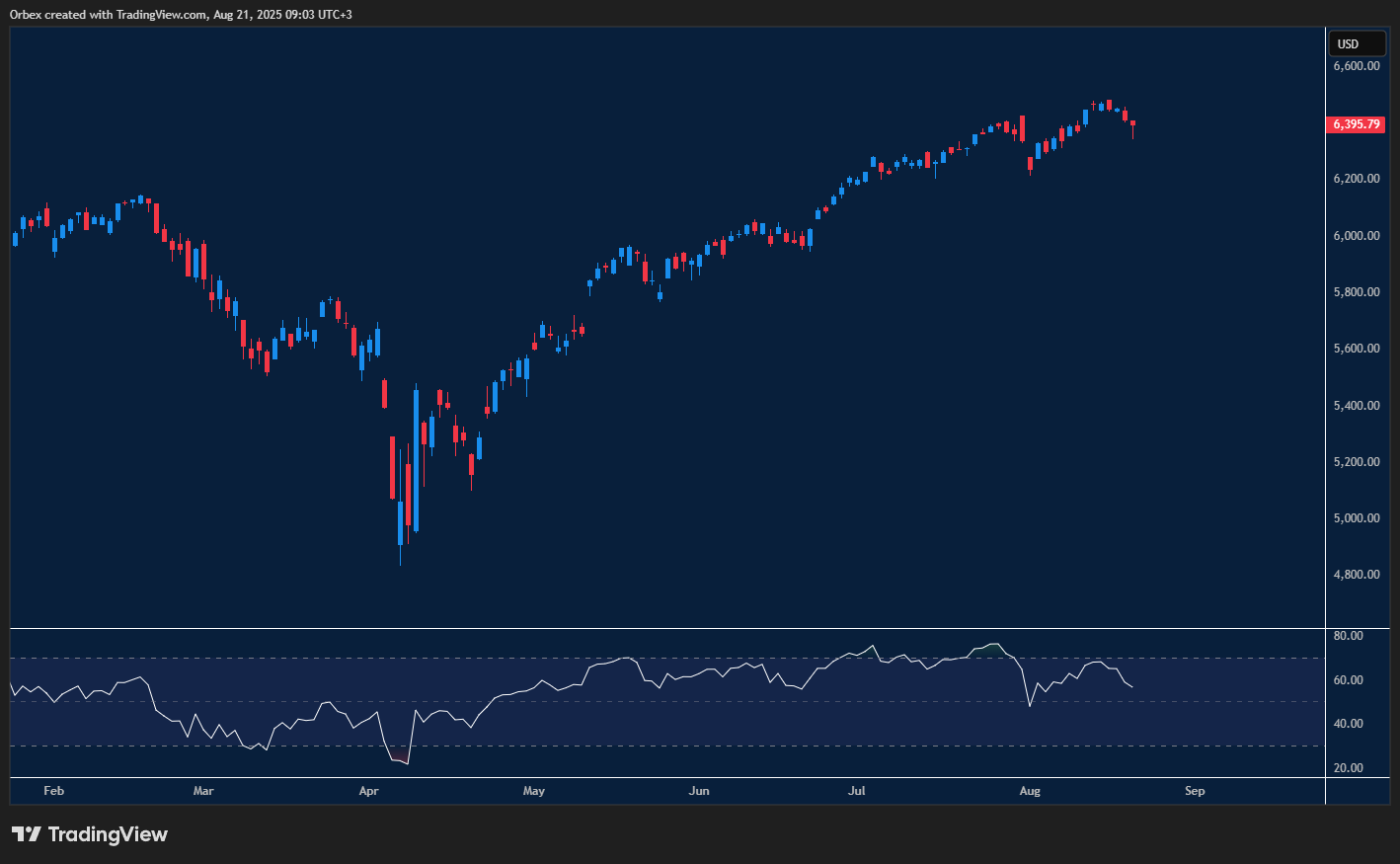

SPX 500 tech stocks begin to slide

The S&P took a step back in recent sessions as a broad decline in tech stocks shook the market. Investors are concerned about high valuations and the outlook heading into the 3rd quarter. Last week’s FOMC minutes showed the economy is still vulnerable to high inflation and a possible recession at the end of the year. With a correction in sight, the S&P will be looking for support at 6000, with 6500 as the next target higher.

AUDUSD breaks to a fresh low

The Aussie remains under pressure as the pair dropped over 100 pips in the past week. We could see a further downward spiral as traders prepare for the RBA meeting this week, as the panel is expected to signal their next rate cut. The return to their inflation target in a reasonable timeframe will be the focus, and that could set out the path of the Aussie for the rest of the year. 0.6350 is the next target lower, and 0.6500 is the closest resistance.

UKOIL recovers as tensions heighten

Oil prices jumped higher over fears of a widening conflict in the Middle East. In addition to this, Chinese refineries have placed new orders for Russian crude, which could see an oversupply in the market. With oil inventories decreasing in last week’s EIA report, we could see price action jump from the depths to begin a vast recovery. An uptick in optimism could trigger more buyers in the market, with 70.00 as the first target higher and 66.00 as a fresh support level.

Test your forex and CFD trading strategy with Orbex

The post The Week Ahead – Is the Bubble about to Burst? appeared first on Orbex Forex Trading Blog.