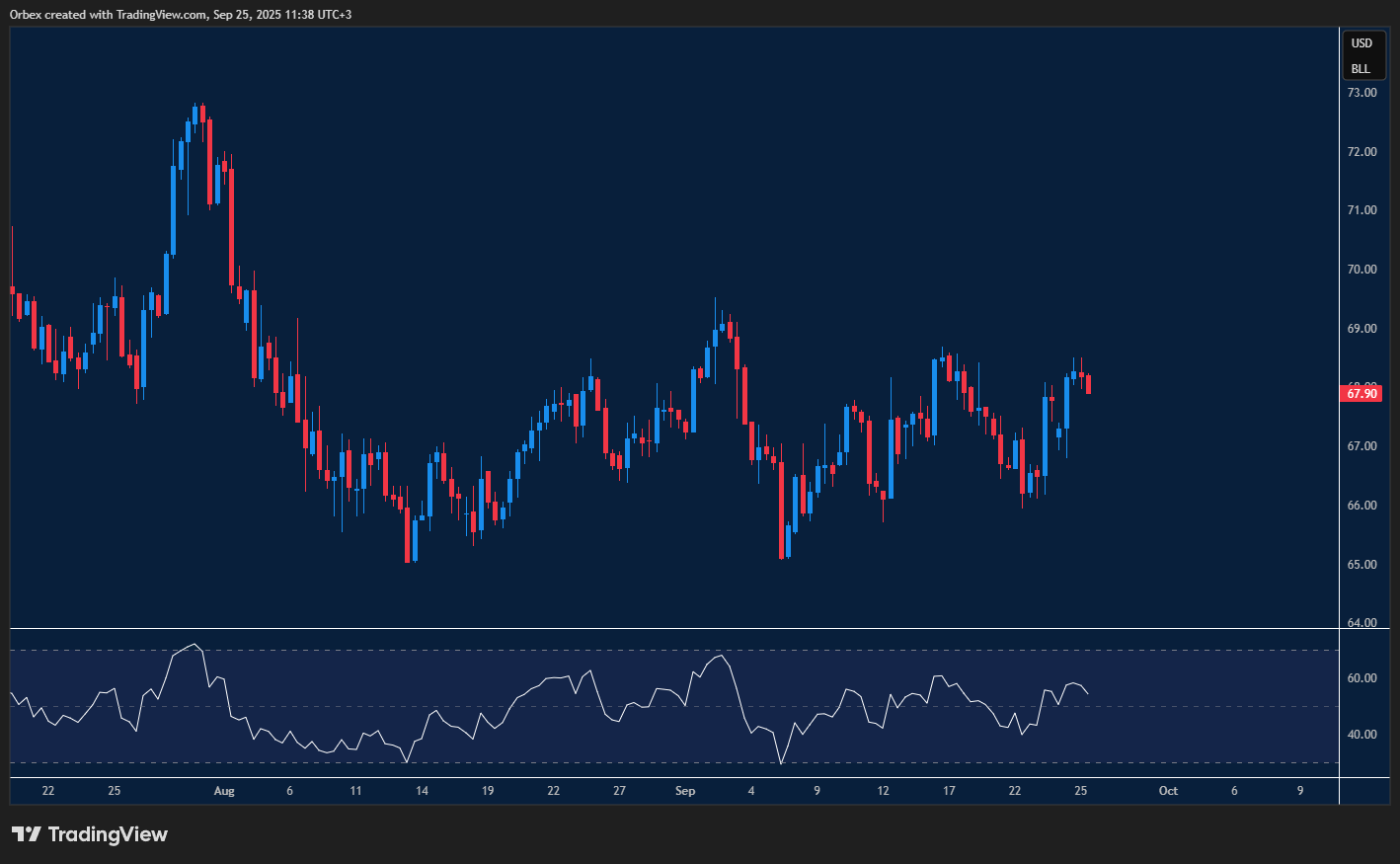

(UKOIL) crude meets heavy resistance

(UKOIL) crude prices remained indecisive with concerns over global demand and elevated risks of a slowdown. The current bullish rally was capped by potential oversupply from the Middle East. With demand in China remaining weak, the expected rebound has yet to show credible signs of commencing as the black gold remains choppy. Brent crude is testing a recent high at 68.20, and 66.00 is the first support level.

NZDUSD hits a fresh low

The Dollar maintains its dominance over its main rivals as the Kiwi continues to suffer. Since the Fed decided to cut its interest rate, the pair has seen a drop of over 200 pips. As traders bought into the rumour, once the news was released, the greenback gained strength, as the Fed warned against a quick series of cuts, reinforcing a cautious outlook. Depending on how this week’s NFP numbers turn out, this could send the Kiwi to 0.5900, with 0.5760 as the first level of support.

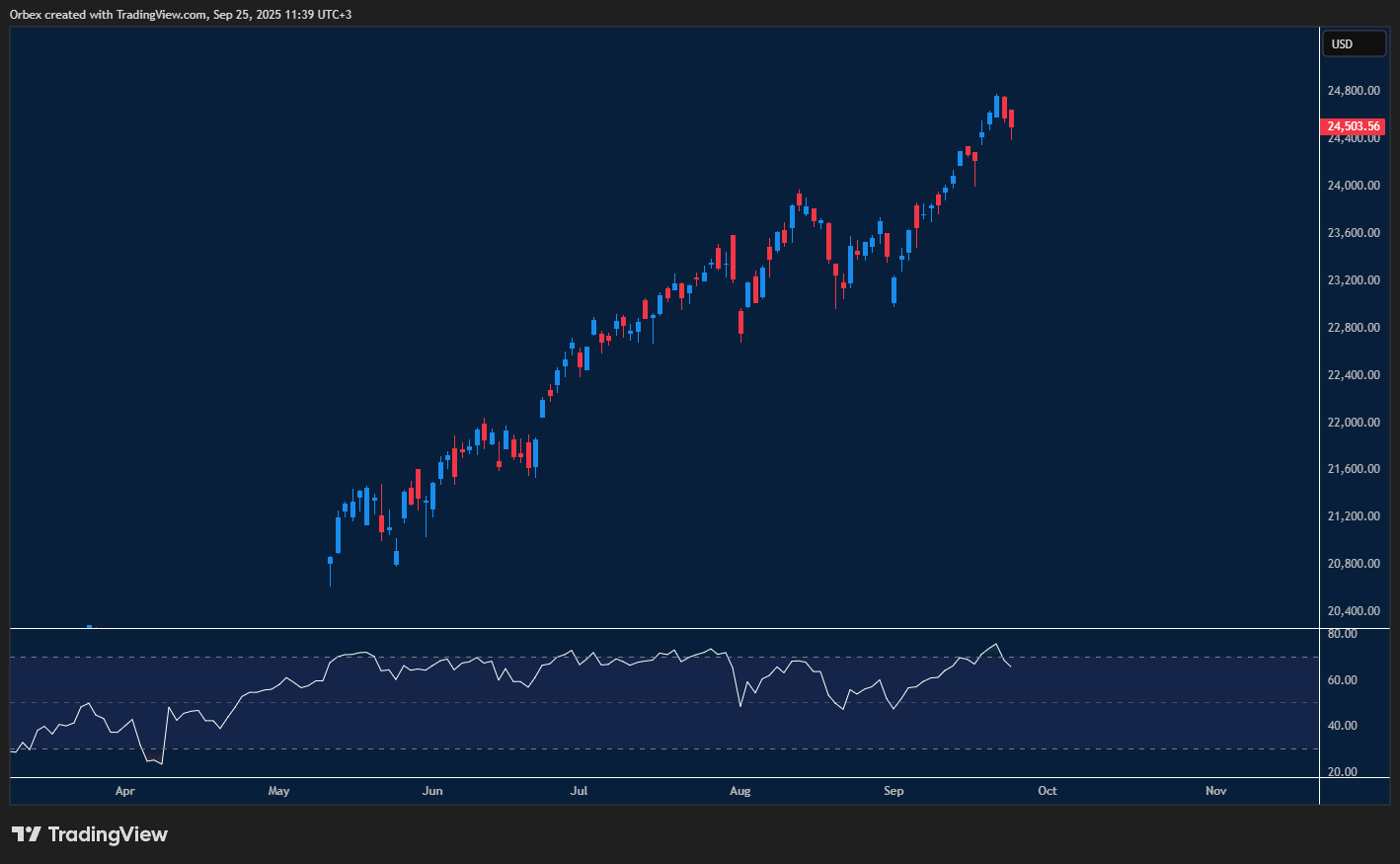

NAS 100 begins sliding

Tech stocks hit a slight barrier as all three major American indices witnessed a pullback. With Nvidia and Apple surging over the past week, many investors are worried about how much more room there is for the stock market to move. With record highs being broken repeatedly, traders are wondering if a correction is around the corner. More dovish signals from the major stocks could cause the index to fall below 23200, with 24900 serving as the first level of resistance.

Test your forex and CFD trading strategy with Orbex

The post The Week Ahead – Riding the Bull Wave! appeared first on Orbex Forex Trading Blog.