EURUSD remains in a bear trap

As the dollar’s dominance persisted amid the Fed’s market-shaking moves last week, fresh doubt emerged over whether another rate cut is coming next month. As the Euro shed over 300 pips from its September high, it was also the turn of the ECB to shore up its defence. With Eurozone inflation not showing any signs of improvement, the central bank will be looking to keep things as stable as possible. 1.1550 is the closest support, with 1.1740 the first level to the upside.

UKOIL falls further

Oil remains indecisive, as a fresh sanctions package against Russia previously saw a spike in price action. After the fundamentals fallout, it was the turn of traders to profit-take as the black gold gave up most of its gains. With tensions still simmering, traders are watching oil with curiosity, as the $80 target by the end of the year remains realistic. The worry of further sanctions is not over yet, and oil could spike higher at any moment. The price could probe the support at 61.00 with 70.00 as a potential target.

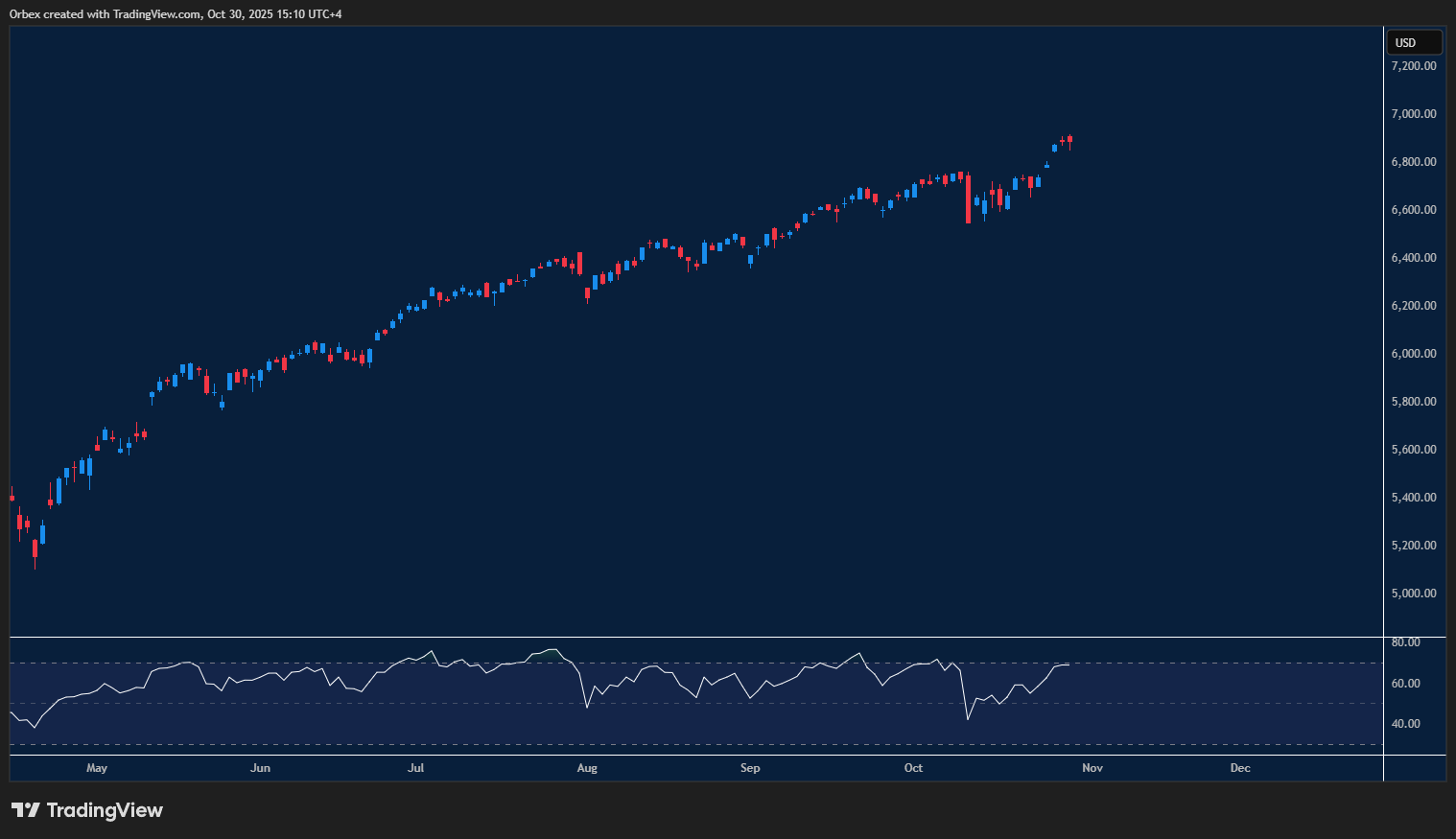

SPX 500 remains steady at record high

The S&P500 reached another record high amid optimism over a strong earnings season report and another rally in tech and AI stocks. With the Fed expected to maintain its dovish stance on rate cuts, stocks in general seem unfazed. As the index powers towards 7000 for the first time, any chance of a pullback would see 6600 as the first support. Corporate earnings will be a significant guide to how far the S&P can go over the next month.

Test your forex and CFD trading strategy with Orbex

The post The Week Ahead – Stick or Twist appeared first on Orbex Forex Trading Blog.