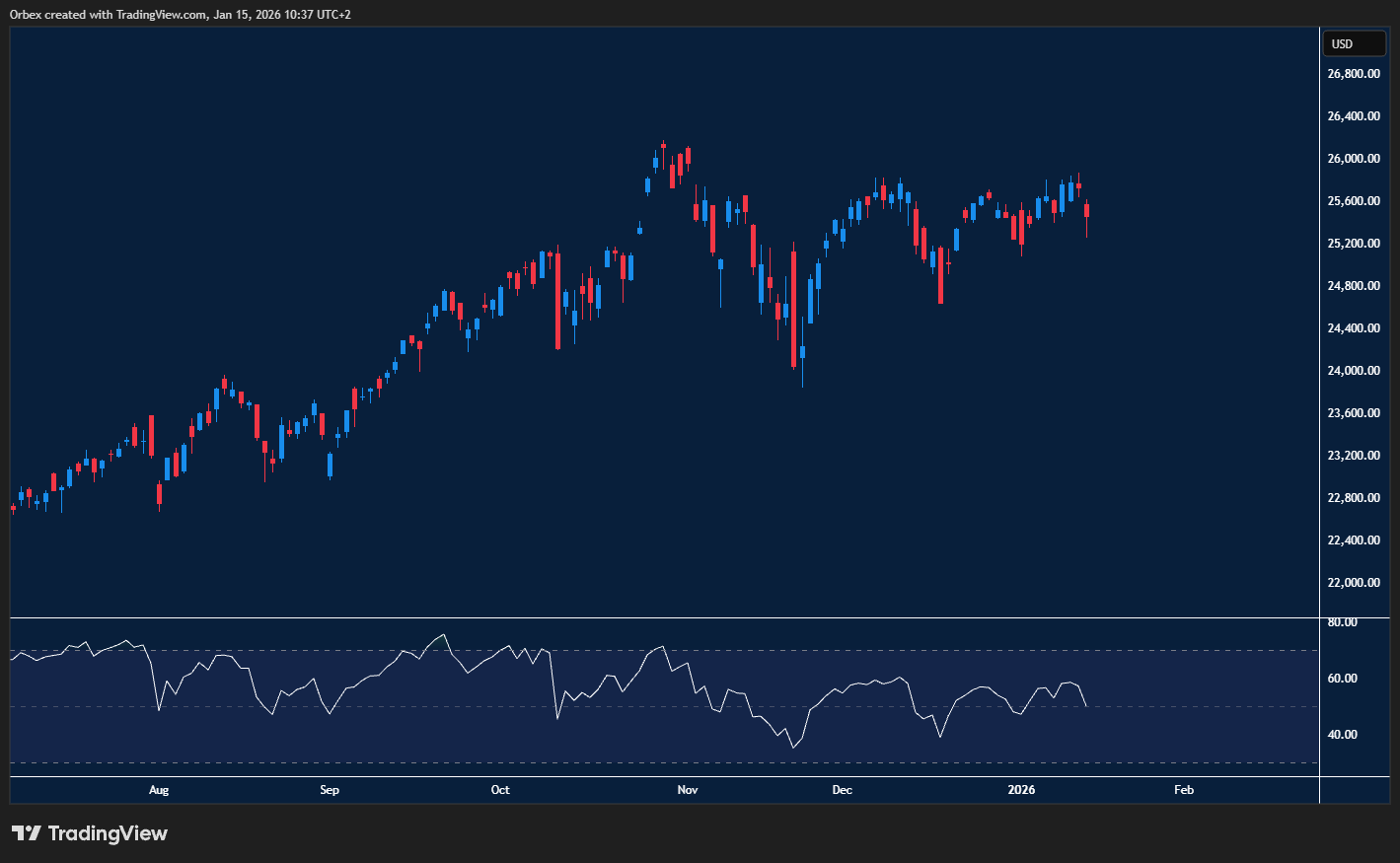

(NAS 100 ) Nasdaq looking for a lift

The (NAS 100 ) Nasdaq took a step back after hitting another high, boosted by tech-related shares. The slowdown doesn’t seem to be hampering the price, as the charts remain bullish as we head into the first quarter. With continuous talk about whether an AI bubble is about to burst, traders will be cautious about going all in and prepared for a correction at some point. 26000 is the next target higher, with 25200 the first support.

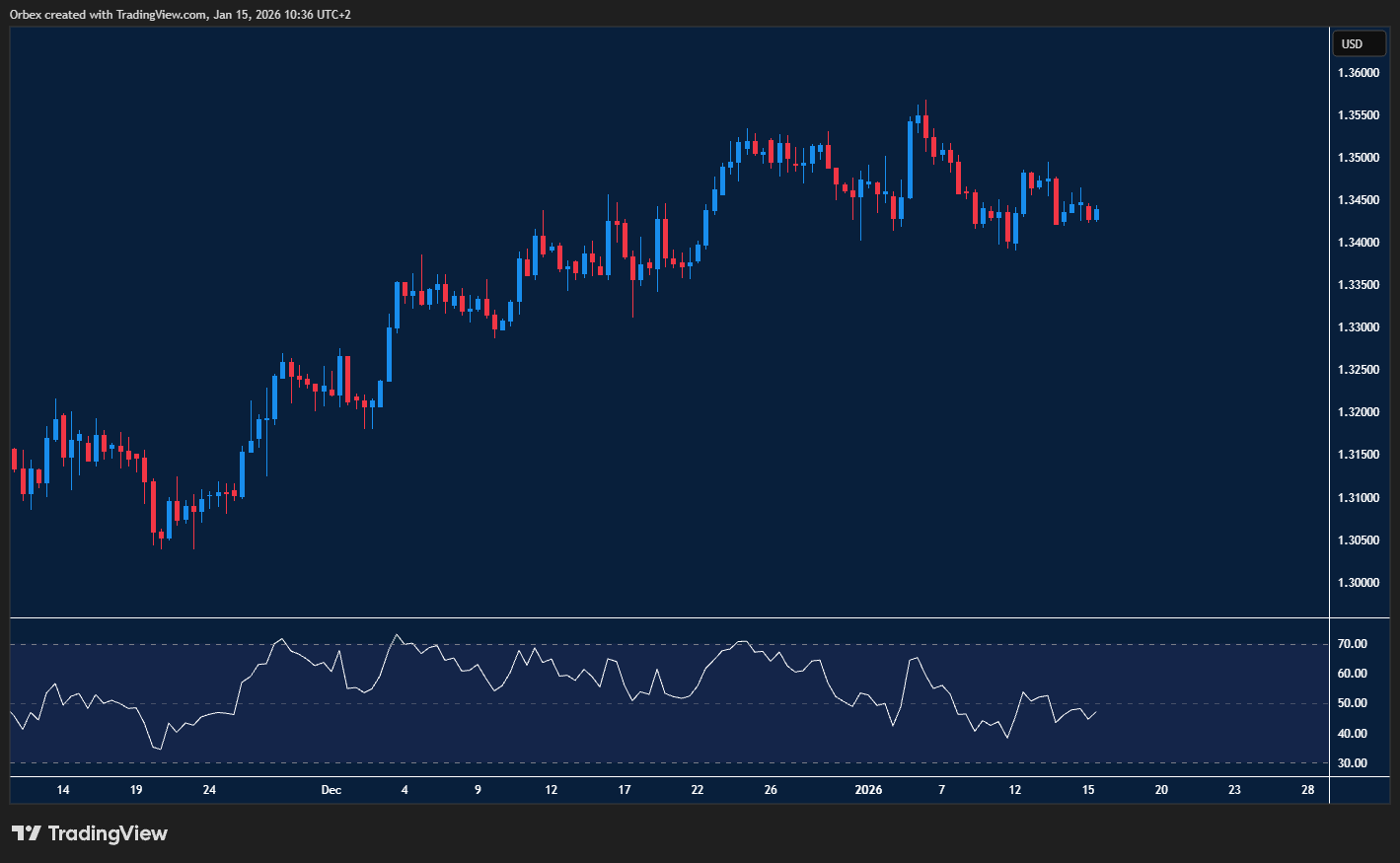

GBPUSD the fightback begins

The recent bull run from the back end of 2025 has seen cable add over 400 pips in value. With progressive US data in the past few sessions, this week’s potential shake-up is how aggressive unemployment and inflation data will be. The pound still has room to move higher, as the greenback looks to personal income to stop an overextension. The price is hovering above 1.3400, and 1.3520 is the first hurdle to continue the rally.

XAUUSD testing more records

Gold continues its ascent as traders digest global conflicts, which are keeping safe-haven assets in the spotlight. Looking ahead, further rate cuts in 2026 could push the yellow metal to record highs. The precious metal has been the gift that keeps on giving as prices have kicked off the year on a bullish note. Gold is holding above 4550, with 4700 as a major ceiling and the next target.

Test your forex and CFD trading strategy with Orbex

The post The Week Ahead – Tensions Run Higher appeared first on Orbex Forex Trading Blog.